This page lists some of the published and unpublished research papers I have worked on.

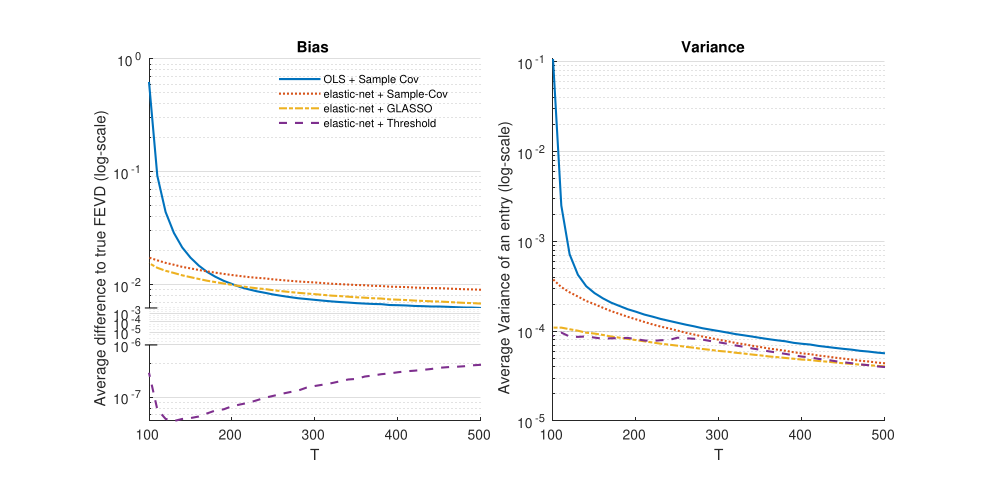

Estimating large-dimensional connectedness tables: The Great Moderation through the lens of sectoral spillovers

joint work with Ruben Hipp, published in Quantitative Economics

Abstract: We estimate sectoral spillovers around the Great Moderation with the help of forecast error variance decomposition tables. Obtaining such tables in high dimensions is challenging because they are functions of the estimated vector autoregressive coefficients and the residual covariance matrix. In a simulation study, we compare various regularization methods on both and conduct a comprehensive analysis of their performance. We show that standard estimators of large connectedness tables lead to biased results and high estimation uncertainty, both of which are mitigated by regularization. To explore possible causes for the Great Moderation, we apply a cross-validated estimator on sectoral spillovers of industrial production in the US from 1972 to 2019. We find that the spillover network has considerably weakened, which hints at structural change, for example, through improved inventory management, as a critical explanation for the Great Moderation.

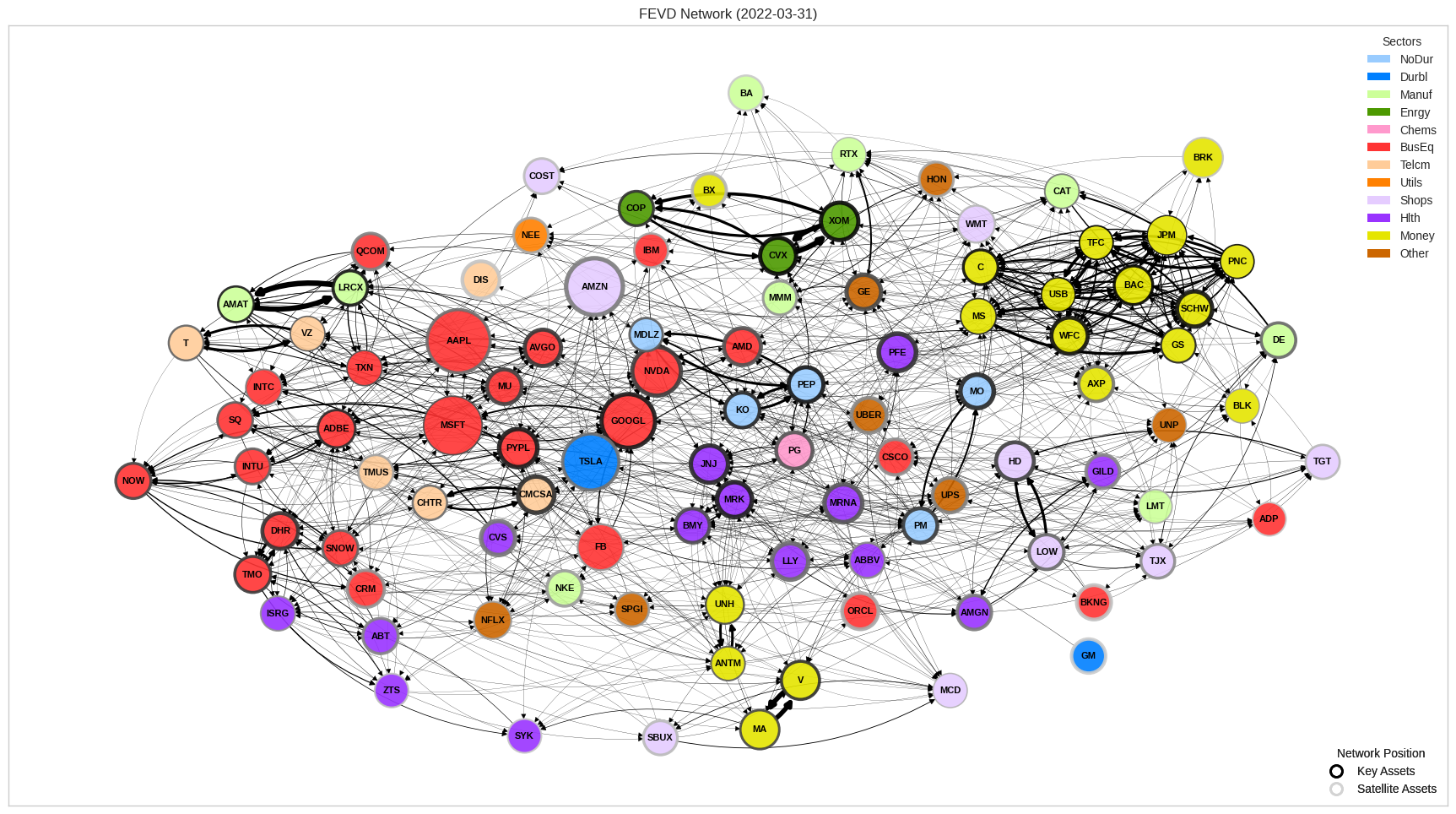

Echo-nomics: Do market returns resonate with granular innovations?

joint work with Ruben Hipp

Abstract: This paper investigates the interplay between asset-level innovations and aggregate market variation through the lens of a directed spillover network. Utilizing high-dimensional samples with daily data of 100 US stocks, we probe the “granular hypothesis” in a network setting and explore two key aspects. First, we establish the presence and dynamics of a directed spillover network in asset markets, demonstrating the potential for granular innovations to propagate in the cross-section of stocks. We find that spillover intensity and assets’ relative importance are fast-changing and usually short-lived. Second, we test whether such a spillover network, combined with a concentrated size distribution, enable granular shocks to significantly influence aggregate market outcomes. The results indicate a positive significant effect from micro innovations to the aggregate market index. Thus, both findings bring into focus a potential missing link in financial market models — the inter-asset spillover network — which helps to connect micro-economic narratives to macro-financial outcomes.

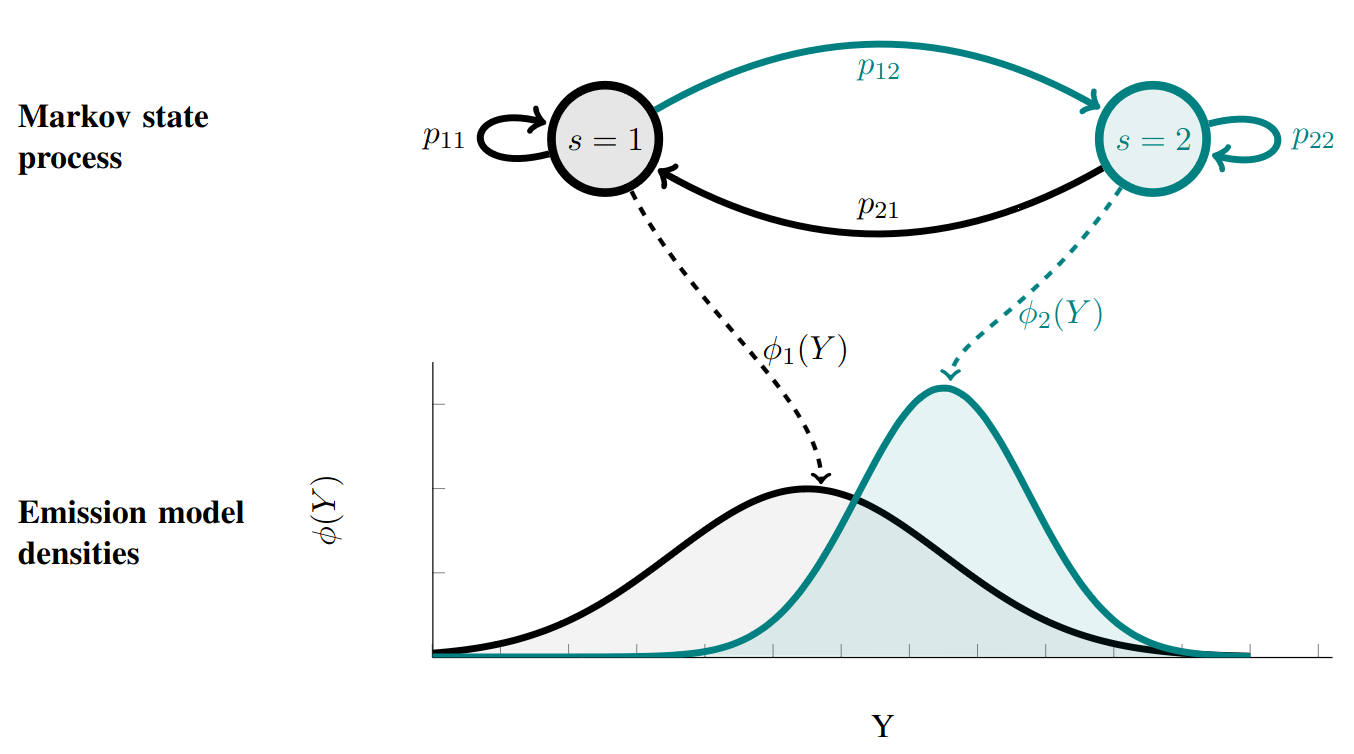

Dynamic density forecasting with Hidden Markov Models

in development

Abstract: I demonstrate how dynamic probability densities can be obtained from the encompassing class of Hidden Markov Models. Density forecasts under such models cover a wide range of shapes that evolve following the model dynamics. I then benchmark the HMMs’ capabilities to model data generating distributions in-sample and out-of-sample in a simulation study. Finally, I apply the model to real-world financial and economic data.

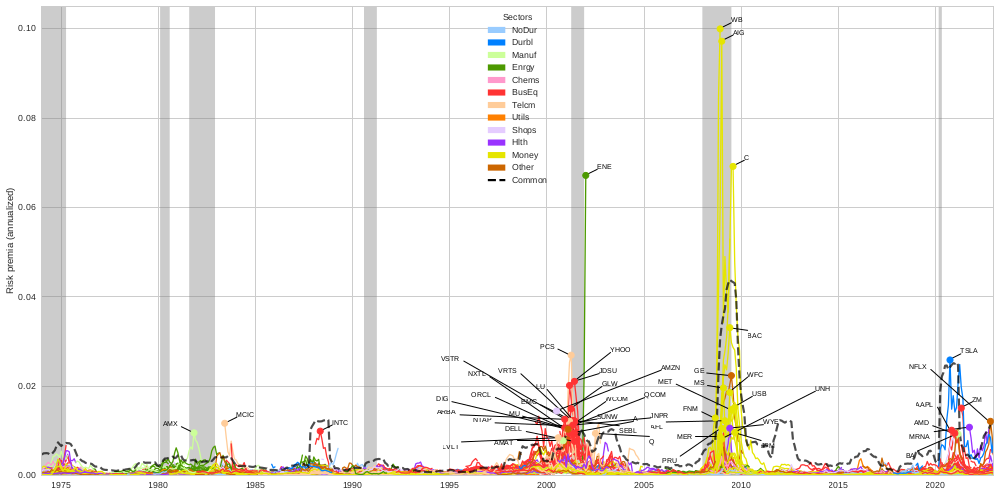

Granular risk premia

draft version under review

Abstract: In a network connectedness model of US equity prices, granular innovations at the firm level can have systemic effects for two reasons: Index weights are too concentrated for diversification arguments to apply, and spillovers propagate non-systematic innovations to a large portion of investor wealth. In this study, I introduce a pricing kernel that includes structural connections and show theoretically that inter-asset connectedness has implications for expected returns. I empirically investigate various conjectures to validate this framework and its quantitative relevance by using estimated spillover networks of 100 US equities. My results imply that risk premia for firm-level innovations exist temporarily and relate to mean returns in the cross-section of stocks. I collect evidence that such granular risk premia could be an overlooked determinant of asset prices, consistent with the continuous emergence of anomalies relative to reduced-form factor pricing models.